India’s Whisky Wall: What 70% Shelf Space Says About Alcohol Strategy in Indian Travel Retail

Walk through the duty-free stores at Delhi, Mumbai or other Indian International Airport and one truth becomes instantly clear: whisky rules the shelves. Not metaphorically, but physically.

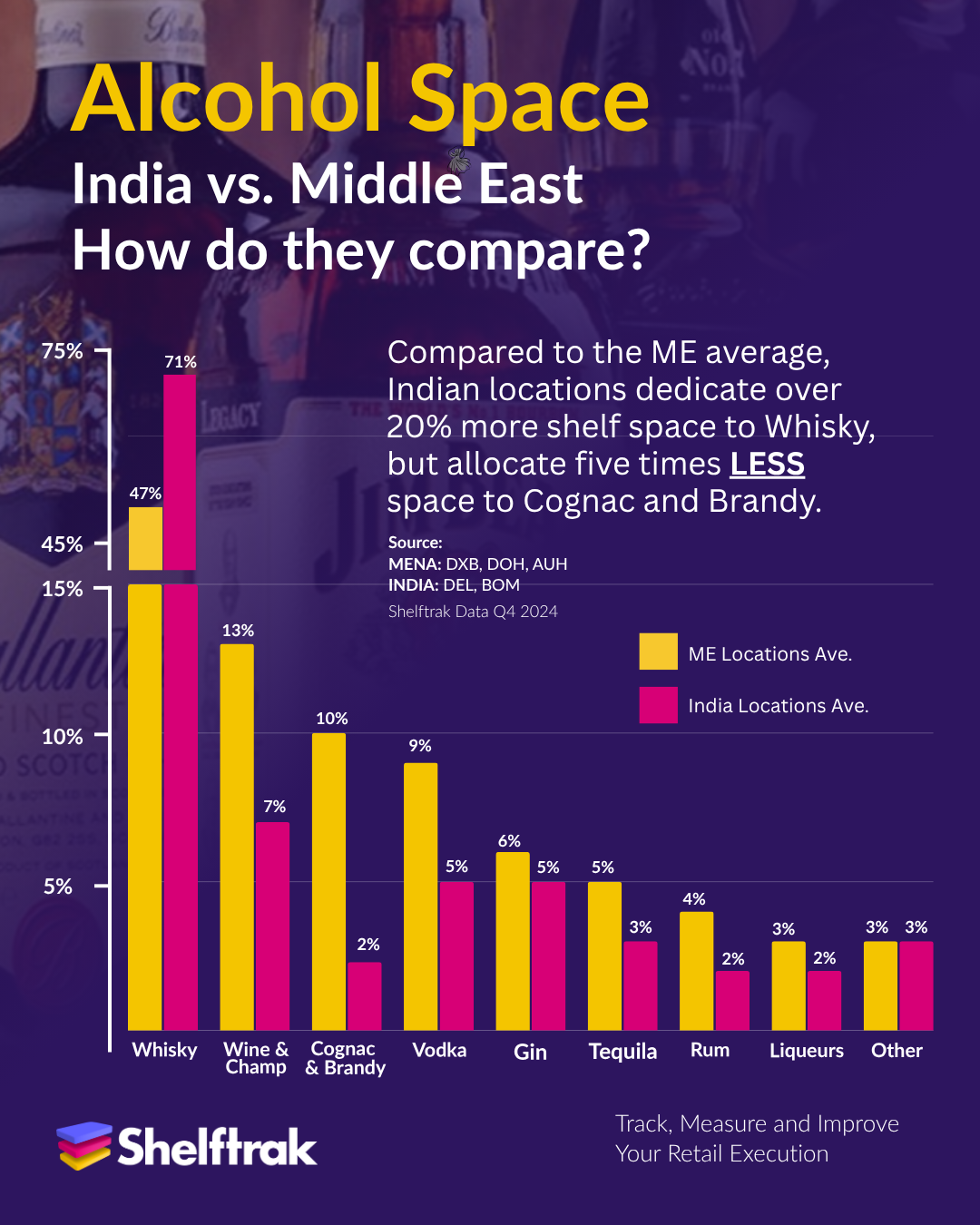

According to the latest Shelftrak analysis, more than 70% of all alcohol shelf space in Indian travel retail is allocated to Whisky, dwarfing the representation of all other categories. In contrast, across the key MENA airports, space allocation is more balanced with around 50% of their space dedicated to Whisky. However this difference creates an altogether different retail environment for brands to succeed in.

This difference in macro-level space allocation is more than a merchandising choice; it’s a strategic signal that shapes shopper experience, brand visibility, and ultimately, conversion. And it carries important implications for both Whisky brands and their peers in segments like Wine, Cognac, Vodka, and the growing segment of Tequila.

The Space Reality: Whisky Dominates in India

Shelf space is the most precious real estate in duty-free retail. In India, the data shows an emphatic vote for Whisky. Across Delhi and Mumbai, Whisky doesn’t just lead, it consumes the alcohol category.

Specifically:

Over 70% of alcohol display space is dedicated to Whisky.

Within that, Blended Scotch takes the lion’s share at 49% of this allocation.

Single Malt Scotch follows at 35%, showing a strong skew towards premium.

American and other whiskies collectively round out the category.

By contrast, the MENA average shows whisky at 47% of alcohol space - still dominant, but with noticeably more room left for Champagne, Cognac, and other key segments.

What’s Left for Everyone Else?

The most striking impact of Whisky’s dominance in India is the compression of space for all other alcohol categories. If whisky claims over 70% of the pie, that leaves just under 30% to be shared among everything else.

Here’s what that looks like:

Champagne & Sparkling wines hold just 1.4% of space in Indian travel retail, compared to 5.8% in MENA.

Cognac & Brandy, a key premium segment, also suffer from reduced visibility.

Vodka and Tequila are barely present, often relegated to a corner or single shelf.

In MENA stores, these segments enjoy greater visibility, better facings, and more balanced display and therefore supporting a wider shopper base that allows for impulse and browsing behaviour.

The outcome? In India, non-whisky brands must compete fiercely for limited shelf presence. It’s a high-stakes battle, with visibility, price-point differentiation, and promotional creativity determining who breaks through.

Why India Chooses Whisky

The skew toward whisky is not arbitrary and it reflects deep-rooted traveller demand, cultural preference, and shopper psychology.

According to studies from industry reseachers:

Indian travellers over-index on liquor purchases, especially for gifting and celebration.

Prestige and familiarity drive purchasing decisions, with Scotch whisky brands offering both.

Whisky is seen as aspirational and premium, even at mid-tier price points.

Add to that the emotional role of whisky in Indian social life and it’s clear why retailers have chosen to amplify its presence.

MENA’s Broader Strategy

Meanwhile, MENA airports, serving a more diverse shopper base, ensure space allocation reflects the travelling popultion. While whisky still leads, there’s clearly a greater category balance.

This balance broadens appeal and allows for more inclusive inter-category storytelling.

The Double Mandate for Brand Suppliers

So what does this mean for alcohol suppliers, especially those eyeing growth in Indian travel retail?

1. Whisky Brands: Curate with Precision

With such overwhelming shelf space dominance, Whisky brands in India must earn their footprint through curation and execution. Simply being present isn’t enough.

Consider:

SKU Rationalisation: Ensure the range offered covers all key shopper needs and occasions but doesn’t explode just for the sake it.

Packaging and Format: Larger formats, exclusive editions, and gift appropriate offers are key to driving higher ticket value.

Promotional Support: Value-added offers can differentiate you within a saturated category.

Brand Story-Tellerd: Trained staff who can educate on product heritage or suggest alternatives can dramatically improve conversion.

2. Non-Whisky Brands: Fight Smart for Visibility

For non Whisky brands, the space challenge in India is real, but not insurmountable. To compete in the margins:

Drive Visibility Beyond the Shelf: Consider secondary placements, promotional islands, or brand-experience fixtures that stand out.

Leverage Local Occasions: Stand out for festivals like Diwali and Eid - linking to these events can elevate relevance.

Champion Relative Premium: With limited space, push only appropriate expressions that carry the right message and appeal.

Create Intrigue: Sampling and real storytelling can bridge the gap when shelf presence is limited.

Strategic Collaboration

Retailers and suppliers must align closely in India to ensure that space efficiency doesn’t compromise shopper experience. Whisky’s dominance is warranted, but diversity in offer remains essential. The real challenge isn’t removing whisky, it’s ensuring the 30% left behind performs hard and smart.

Retailers can consider rotating thematic zones to give other categories moments in the spotlight. Suppliers, in turn, should support these efforts with high-impact content and activation.

Conclusion: Respect the King, Empower the Court

India’s alcohol shelf space story is clear: Whisky wears the crown, claiming more than 70% of retail real estate. But kings don’t rule alone. The supporting cast must be nurtured, supported, and allowed to shine, even in smaller pockets.

In travel retail, space allocation is more than logistics, it’s strategy made visible. Whisky’s rule in India is a testament to cultural demand and commercial logic. But a well-run kingdom ensures everyone has a voice.

For brand suppliers, the task is twofold: respect Whisky’s dominance, but don’t let it drown you out. Curate, differentiate, and be bold in your pursuit of visibility. The shopper’s eye—and wallet—will follow.

Don’t leave your travel retail success to chance

Shelftrak helps you monitor and optimise every display across your global duty-free footprint. Book a demo to see how our solution ensures you turn travelers’ heads – and capture their purchases – every time.